Section 12B Investment

FUTUREDEV INVEST'S DEDUCTIBLE SOLAR INVESTMENT

Futuredev Invest is offering South African investors the opportunity to take advantage of the energy supply crisis in South Africa and to gain exposure to an asset class that provides long-term predictable yields.

Futuredev Invest’s Tax-Deductable Solar Investment combines the predictable return nature of the solar sector with the tax benefits available in the National Treasuries renewable energy incentive.

SECTOR FOCUS / MANDATE

Futuredev Invest’s Tax-Deductable Solar Investment will be focused on providing a funding solution to renewable energy providers who are supplying commercial, industrial, and residential consumers with solar solutions.

INVESTMENT CAP

Futuredev Invests Tax-Deductible Solar Investment initial capital raise will close when R100 million has been raised.

INVESTMENT HIGHLIGHTS

TAX BENEFITS EXPLAINED

Similar to Section 12J Investments, Futuredev Invest’s Tax-Deductable Solar Investment allows investors, through Section 12B of the Income Tax Act the ability to claim a 125% tax deduction on their investment.

In other words, if an investor* in the top tax bracket invests R1 million into Futuredev Invest’s Solar Tax-Deductible Investment, the investor will be able to reduce his/her taxable income by R1 2500 000, thereby resulting in a tax saving/refund of R562 500.

The 125% deduction can be used to reduce the investor’s taxable income, thereby reducing his/her income tax and/or capital gains tax liability.

RISKS

As with any investment, there are numerous risks investors need to consider. With this investment, we believe that there are two main risks, namely:

- Credit risk: The performance of this investment is dependent on the consumer’s ability to make regular payments towards their energy consumption. To mitigate this risk, Futuredev Invest will be undertaking an in-depth due diligence and credit check on each energy consumer or project owner as well as diversify its investments across multiple projects.

- Deployment risks: Investors will only be entitled to claim a tax deduction, in the year of investment, if the solar project/s are producing electricity. In this regard, Futuredev Invest will limit its capital raise to projects that can be executed within the year of investment.

RISKS

Cash-inflows:

Futuredev Invest’s Tax-Deductible Solar Investment aims to generate a consistent annual yield paid to the investor over a period of 10 years.

Below is an example of cash inflows* to the investor over the period of the investment.

Milestones | Cash-Inflows to the investor |

|---|---|

SARS refund | R562 500 |

Year 1 - Pre tax income (after fees) | R153 376 |

Year 2 - Pre tax income (after fees) | R157 823 |

Year 3 - Pre tax income (after fees) | R162 400 - Investor de-risked - pre-tax |

Year 4 - Pre tax income (after fees) | R167 108 |

Year 5 - Pre tax income (after fees) | R171 953 - Investor de-risked - post-tax |

Year 6 - Pre tax income (after fees) | R176 938 |

Year 7 - Pre tax income (after fees) | R182 067 |

Year 8 - Pre tax income (after fees) | R187 343 |

Year 9 - Pre tax income (after fees) | R192 772 |

Year 10 - Pre tax income (after fees) | R358 356 |

Cell | Cell |

Total pre-tax income + tax benefit (net of fees) | R2 472 635 |

Total post tax + tax benefit (net of all fees) | R1 528 718 |

Cell | Cell |

Pre-tax IRR + tax benefit | 29% |

Post tax IRR + tax benefit | 18% |

Fees

Management fee:

Performance fee

2.25% p.a.

20% above a hurdle of the investment amount, calculated and charged annually with a high-water market (with catch-up) - see explanation.

Futuredev Invest earns a performance fee only on returns generated above the investment amount divided by the investment period with catch-up. As an example, if an investor invests R100, and Futuredev Invest returns R12 in one year, Futuredev Invest would charge a fee of 20% on the R2. If in year two, Futuredev Invest returns R5, then no performance fee would be earned. For Futuredev Invest to earn a performance fee in year three, Futuredev Invest would need to return more than R15.

Frequently Asked Questions

Section 12B of the South African Income Tax Act entitles taxpayers to claim an accelerated wear and tear

allowance on assets owned and brought into use by the taxpayer for trade in generating various forms of

renewable electricity.

For the period 1 March 2023 to 28 February 2025, the Section 12BA allowance has been increased from 100% to 125% and no maximum cap on the output of the solar installation.

A: Investor invests R100,000 in May 2023.

The full amount is invested into the solar kit that starts generating energy in July 2023.

The investor can deduct 125% i.e., R125,000 from their taxable income for the year ended February 2024.

B: Investor invests R100,000 in May 2023.

Only R70,000 is invested into the solar kit that starts generating energy in the year ended February 2024.

The investor can deduct R87,500 (70,000 X 125%) from their taxable income for the year ended February

2024. The balance of R37,500 (30,000 X 125%) can be deducted from taxable income in the following tax year when the balance of the solar kit comes into operation.

PLEASE NOTE: The adjusted tax incentive will only be available for installations that generate electricity for the first time between 1 March 2023 – 28 February 2025.

To own and operate alternate energy-generating assets, and sell the electricity generated to a portfolio of

creditworthy counterparties (sectional title complexes, industrial and commercial installations) bound by

long-term power purchase agreements.

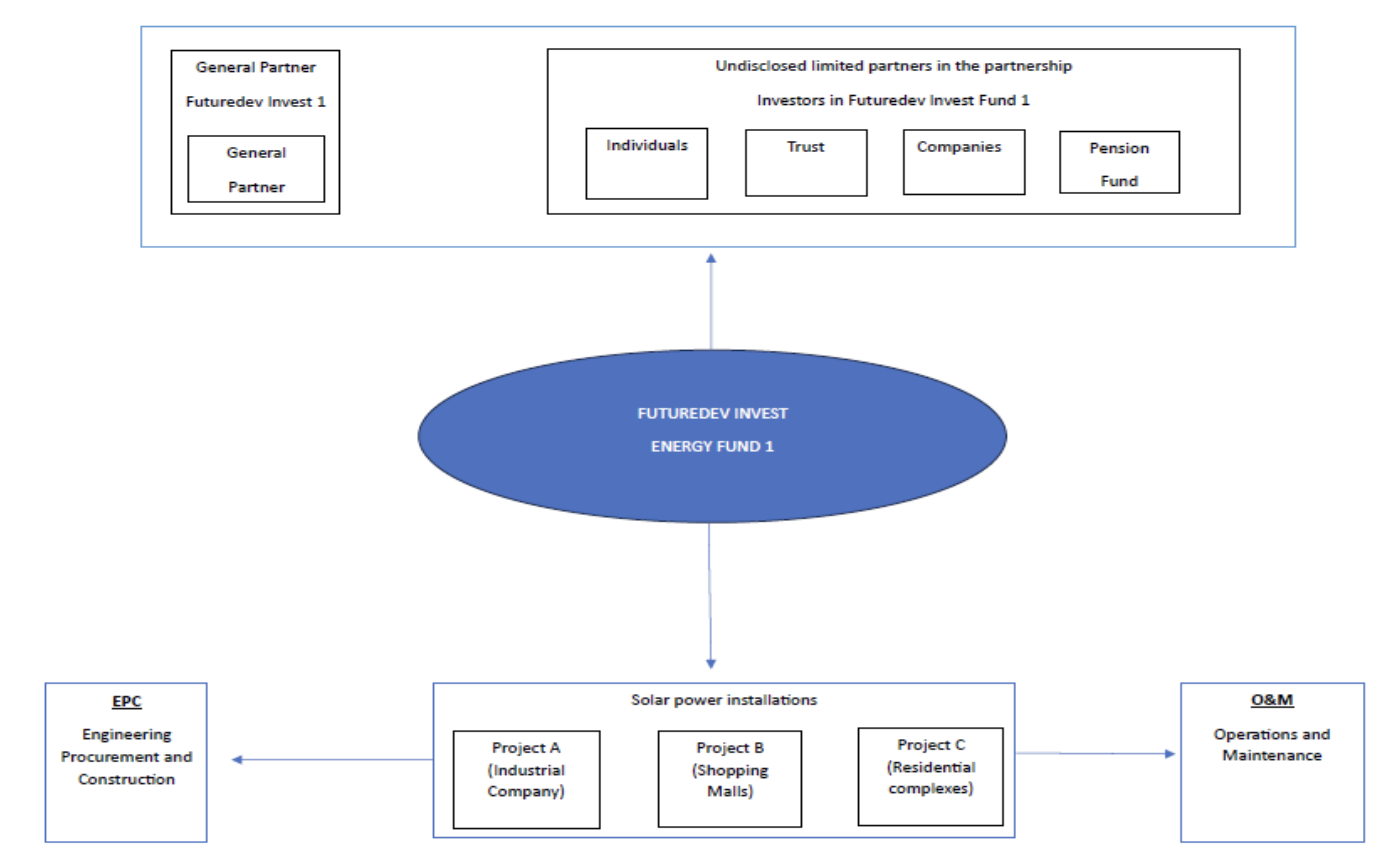

Individuals, trusts, and companies can invest into the Fund. Pension Funds are also permitted to invest in

the Fund as governed by Regulation 28 of the Pension Fund Act.

The Twelve B Green Energy Fund is structured as an an commandite partnership. A commandite

partnership structure is most used by private equity Fund Managers in South Africa.

It comprises two categories of partners:

- Undisclosed limited liability partners – the investors into Twelve B Green Energy Fund

- The general partner: Twelve B GP 1 (Pty) Ltd

The two categories of partners enter into a partnership agreement that co-own the assets in which the Fund invests.

Investors contribute a fixed sum in exchange for a percentage share in the partnership. The liability of the

investors is limited to their capital contribution into the Fund.

The net income earned by the partnership is distributed to the investors in accordance with the ratio of

ownership as set out in the partnership agreement.

A limited partner (investor) comprises an individual, trust, company, or pension fund who contributes

capital into the partnership. The investor’s liability is limited to the amount of his/her investment into the

Fund.

The general partner is in ultimate control of the Fund. It appoints the Fund Manager to manage the Fund on a day-to-day basis on its behalf.

The GP’s liability is unlimited in relation to the partnership.

A Deed of Adherence is a supplementary legal document that is used to bind an investor to the partnership agreement.

A power purchase agreement (PPA) is a long-term electricity supply agreement between the partnership,

being the energy producer and an offtake.

The PPA sets out the amount of electricity to be supplied, the initial pricing, the annual escalations, and

penalties for non-compliance.

An offtaker is a consumer of the electricity generated by the solar assets deployed at the premises of the

offtaker.

Offtakers may be sectional title complex, industrial or commercial installations.

Ten years.

Fund 1 is raising R200 million only. This will be on a first come, first serve basis.

The Fund has a pipeline of projects ready for deployment that will become energy-generating by 28

February 2024, entitling you to claim the 125% tax deduction in the tax year.

The Internal Rate of Return (projected IRR): ≈ 18% (net of fees and taxes on risk capital).

Distribution policy

Investors will receive bi-annual distributions from the profits of the sale of the electricity:

- First distribution – September 2023.

- Average annual yield: 14.22% p.a. on your investment amount

- Average annual yield: 32.51% p.a on risk capital invested.

The IRR is a metric used to estimate the return on the investment having taken into account the time value of money.

- A dividend is paid by a company as a share of profits to the shareholder as a consequence of him/her owning shares in a company.

- A distribution is a share of the profits paid to a partner as a consequence of him/her being a partner in a partnership agreement.

- Dividends are subject to dividends withholding tax after having paid company tax of 27%.

- Distributions are paid directly to the partner and are taxed directly in the partner’s hands.

Given that the Twelve B Green Energy Fund is a partnership, investors receive distributions.

The profits of the partnership which have been generated from the sale of electricity, net of costs, are

distributed to investors bi-annually in March and September each year.

The first distribution will be in September 2023.

It is the cumulative annual distributions of the Fund to investors as a percentage of investors’ capital

contribution.

No, funds will be deployed into a portfolio of energy-producing assets. It is anticipated that the Fund will invest in approximately 30 projects.

Once the financial statements of the Fund have been audited by the Fund’s auditors, a detailed tax summary will be sent to each investor.

This summary will confirm the amount of the Section 12BA deduction as well as his/her share of profits that should be included in your tax return for the tax year ended February each year.

Yes, it may be carried forward to the successive year, and set off future taxable income.

The investment risk profile is moderate.

The funds will be deployed into a portfolio of solar projects in different locations, with different offtakers.

Each project will be bound by a long-term PPA which sets out the amount of electricity to be supplied, the

initial pricing and the annual escalations.

All solar equipment is covered by an all-risks insurance policy for lightning, floods, theft, etc.

Counterparty risk is mitigated as the solar equipment is movable and can be moved to another site if

required.

- Non-payment by offtakers. However, the portfolio is made up of a number of offtakers, so each offtaker will only represent a small portion of the Fund. One can also repurpose the solar kit for another offtaker at an alternate site.

- Helioscope projections are utilised to size solar equipment to ensure that energy production is matched to usage.

Yes, it is regulated by the Financial Sector Conduct Authority (FSCA).

The Fund is administered by Grovest, the pioneers of Section 12J, who operationalised the first Section 12J Fund in 2014. The Section 12J market grew to over R12 billion when the sunset clause was reached in June 2021. Today, Grovest is the largest administrator of Section 12J Funds, with over R3.5 billion in assets under administration.

Yes, it is. This amount is determined at the time of exit based on the selling price of the portfolio.

You are deemed to have exited your investment once the portfolio is sold to a third party.

At the end of the 10-year Fund term, the portfolio of energy-generating assets will be sold into the active

institutional market for moderate risk, high-yielding, long-term investment instruments.

To enhance investor returns, the Fund term may be extended for a further two years, at the discretion of the Fund Manager.

In the unplanned circumstance of exiting early, the investor will need to request this from the Fund

Manager. Subject to the working capital requirements of the Fund, the Fund Manager may repurchase your investment at an appropriate discount at the time.

The earlier the exit, the higher the discount will be.

At any point in the 10-year term, an investor may sell their partnership interest to a third party.

If an investor disposes of their investment before the end of the Fund term, or at the end of the Fund term, the investment will be subject to a portion of the recoupment of the value of the solar assets at the time of disposal and is to be included in the investor’s tax return in the year in which the investment is sold.

Set-up fee:

A set-up fee of 1% (once off) of capital raised is paid to the Manager.

Management fee:

A management fee of 2% per annum is paid to the Manager on the capital invested. This fee is paid quarterly in arrears.

Performance fee:

The Manager will earn a performance fee of 20% on all distributions after first returning 110% of risk capital to investors.

All monies received from Shariah investors will be invested into a Shariah-compliant bank account until deployed into qualifying assets.

All projects are approved by an experienced Investment Committee before they are implemented. The Investment Committee will select a diversified portfolio of projects to mitigate for concentration risk.

The Investment Committee will consider investments based on the following:

- The offtaker must be credit-worthy with historic electricity invoices to validate usage.

- The offtaker must enter into a long-term power.

- Purchase agreement.

The projects emanate from various sources including engineering, procurement and construction

contractors (EPCs), operations and maintenance contractors (O&M), with whom the Fund has an association, or perhaps the offtakers themselves.

In the current environment and severe crisis in the availability of electricity in South Africa, it is self-evident that there will be numerous projects which require Funding.

Projects also emanate from word of mouth, landlords, managing agents, and property developers.

The Fund will be investing in a portfolio of renewable energy projects focused on sectional title complexes

and select commercial and industrial installations. These installations incorporate the latest technology in

solar panels, inverters, and battery storage.

These are spread across various sectors – multi-family residential, retail, and industrial offtakers. They are

also geographically spread across South Africa.

Currently, the team has approximately R80 million of potential deals in the pipeline.

The minimum investment is R100,000. There is no maximum investment amount.

Environmental, social, and governance (ESG) investing is a form of socially responsible investing that

prioritises financial returns alongside impact on the environment and the planet.

Green energy has become an absolute necessity due to the ongoing lack of reliable electricity and energy

supply in South Africa.

Twelve B Green Energy Fund is an ESG investment committed to sustainability.

Disclaimer: The contents of this page do not constitute and should not be construed as an offer to subscribe for shares or investment, tax, legal, accounting, and/or other advice. For advice on these matters consult your preferred investment, tax, legal, accounting, and/or other advisers about any information contained in this document. All mentioned returns in this document are estimates at current tax rates, and past performance is not an indication of future performance is not an indication of future performance. *in this example, an investor is a natural person with an income tax rate of 45%.

Copyright ©. Futuredev Invest. 2024